So do property prices fall when interest rates rise?

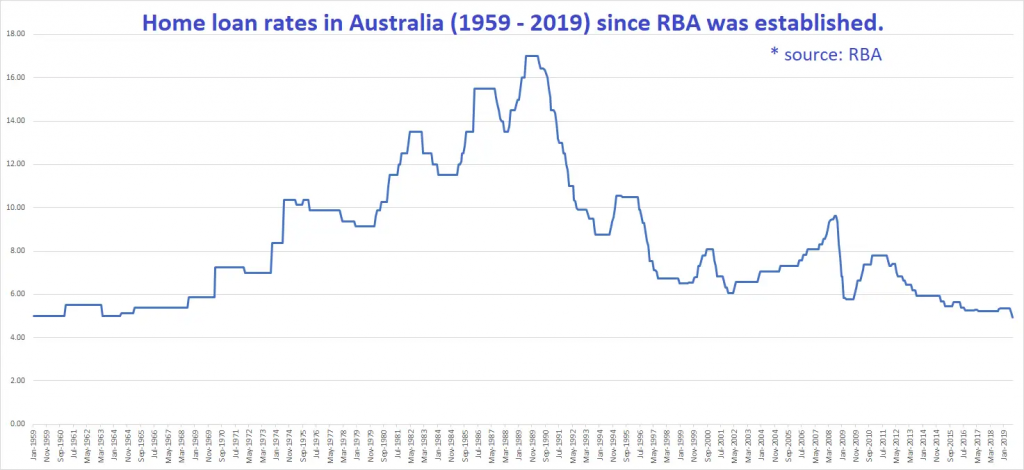

From the table and graphs in this article, between 2002 and 2008, home loan mortgage rates rose from 5.2% to 8.62%

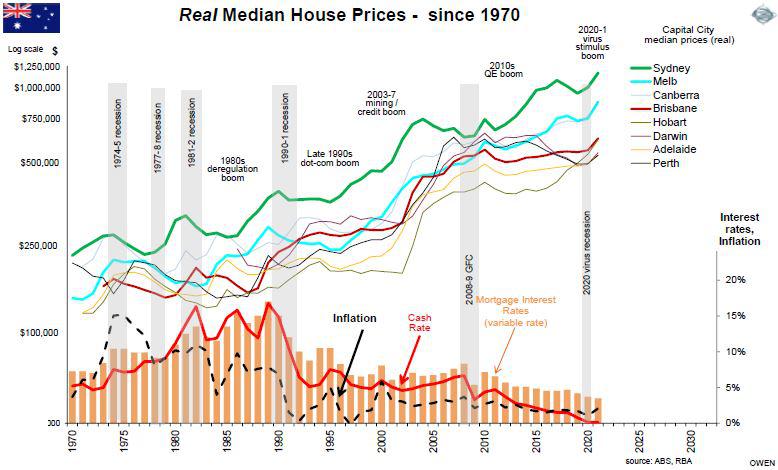

The median house price during this period more than doubled in all capital cities apart from Melbourne, Sydney and Canberra but still showed growth of 53.84% in Melbourne, 31.38% growth in Sydney and 84% growth in Canberra

Between August 2009 and November 2010 interest rates rose from 4.94% to 7.01%. During the same period the Melbourne median house price rose from $488,944 to $520,000

In 1970, interest rates were 6.5% and rose to 17% in 1990.

During this period of high interest rates house prices in Sydney rose from $18,000 in1970 to $147,000 in 1990. An increase of 716.66%.

In Melbourne the median house price rose from $12,800 in 1970 to $131,000 in 1990. A rise of 923.43% during this period

So in summary, I do not believe house prices will fall under the current economic settings.

History illustrates that property prices rarely fall with low unemployment , shortages in house stock inventory or during periods of rising inflation.

Almost every economist and media commentator have predicted a property price fall with some saying this correction will be as much as 15%. I do not concur with this view.

I suppose we shall have to wait and see who is correct!

Get in touch to see how Greville Pabst Property Advisory can help with your next property purchase, sale or lease.